The PFM super-app

Coming from the UK, where it is easy to open a bank account, I have 7, each with a different bank and each having a different banking app. My loans are with another bank, my credit cards are with two other institutions and my savings/investment with another. That is 11 different financial institutions, without including an app for transferring money internationally, two apps for P2P payments and another app for splitting bills. None of these apps or services easily integrate with each other so to get a holistic picture of my financial situation I have a patchwork of siloed products.

Whilst I am in the minority with this many, most consumers will most likely have 3 or more apps and face similar difficulties. Before embarking on my MBA, I wanted to get a better sense of my spending and I was tired of running spreadsheets to figure this out. I came across personal financial management (PFM) apps, which whilst not new, had seen a resurgence recently due to the increasing penetration of mobile phones, better mobile connectivity and a younger generation more accustom to using apps. PFM apps allow you to connect your current accounts, credit cards, mortgage, savings and investment accounts for one hollistic view of your finances.

After much use, I became an evangelist as I saw it as a way to improve knowledge of my financial situation. Emma, the app I use, keeps me engaged with weekly quizzes with prizes, weekly reports, budgeting features like recurring subscriptions and analytics to cateorise my spending. These features drive engagement and give me a reason to open the app. I use my PFM app every few days, compared to any of the other banking apps I use less frequently.

Whilst this is great, what excites me more is for the future. As with all things fintech, the space is changing fast. I believe PFM apps will be the hub of people’s financial lives. By having a comprehensive view of your entire financial situation, something no other app or bank can currently do (and most likely will never do), PFM apps have a deep understanding of users and the possibilities of what can be built on top of them are endless.

Their deeper customer knowledge provides exciting opportunities for financial education, personalised financial products, automated banking, targeted loyalty rewards/offers and bill switching to name a few. This knowledge is a unique value proposition and will propel banking to become something useful, engaging, hyperpersonalised and proactive. Something we want to engage with rather than dread.

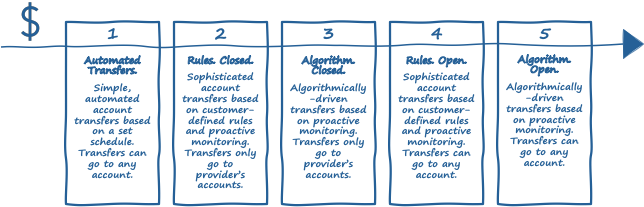

For a real example, through integrating with a company like Multiply.ai, a PFM app could tell a user instead of putting money into a saving money with a low interest rate, they would be better off paying off their credit card debt. Or suggesting personalised financial products that provide better value with automatic switching action if agreed by the user. Instead of having to go to a different app to pay friends or transfer money among accounts, it could be done seamlessly without leaving the app. By having in depth knowledge of your spending habbits, the app could move money around for you to avoid late fees or move any money not needed for a few days into a savings or investment account to work harder for you. It could also know when you could get a better deal on your internet, phone contract or utilities because it sees the monthly or quarterly payments you make. Banking becomes something that happens in the background.

Yes, a bank could offer most of these services, but by putting a user’s interests first they could shoot themselves in the foot and their traditional thinking holds them back from truely innovating. The closest in this space is Monzo which offers bank account switching, energy account switching and early payday loan offerings. Companies that are technology first are nimble, moving quickly to innovate. Banks have difficulty attracting top engineering talent whilst also contending with their legacy siloed core infrastructure.

For all this to occur though, all of these institutions need to be connected, which is why I am also very bullish on the API/infrastructure space as well (a future post to come). However, all current challenger banks are building on top of current infrastructure. They are doing the same things that banks do, with better UI and better features. The real innovation will be when when a bank is build on top of a new technology such as the blockchain for a decentralised finance movement.